Instant payments: send money in less than 10 seconds

Instant payments

With eboo, transfer and receive money instantly.

What are the advantages of instant payments ?

Immediate

Instant payments are SEPA transfers processed immediately. The beneficiary receives the money in less than 10 seconds.

Secure

In addition to standard checks, all instant payments are subject to recipient verification.

Practice

Refund your friend or pay your bills,by simply connecting to your eBanking.

How to make an instant payment?

-

Choose and validate a beneficiary

In the eboo app, choose or create a beneficiary. New: All your beneficiaries are now verified – both new and existing ones.

-

Choose the type of transfers

Instant transfers are activated for defaults – except in exceptional cases.

-

Choose the amount

The procedure is identical to classic transfers.

-

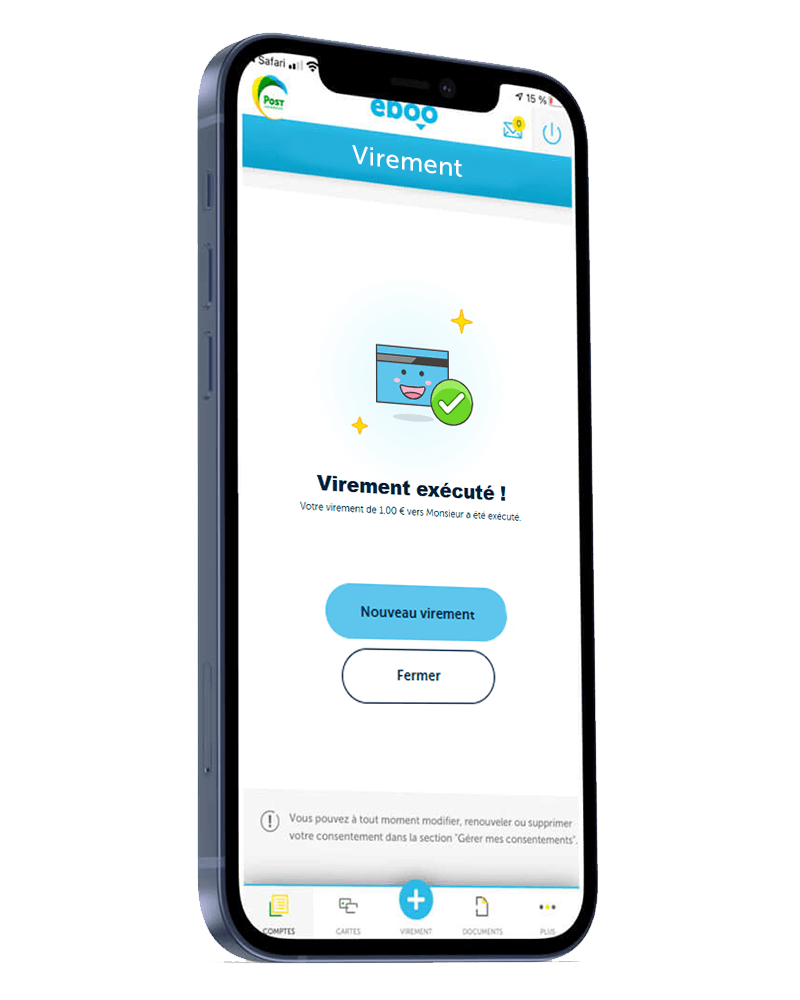

It’s done!

The beneficiary receives the money in less than 10 seconds.

Verification of Payee (VoP)

For more security and reliability, a new tool now allows you to automatically confirm the identity of the beneficiaries during your transfers.

Answers to your questions about instant payments

An instant payment is a transfer of money between two bank accounts that takes less than 10 seconds, 24/7, including weekends and public holidays.

Yes, but it is irrevocable: once validated, it cannot be canceled. That is why an automatic payee verification (VOP) has been implemented within eboo.

No. Only SEPA transfers (in euros, in the SEPA area) are eligible.

No, instant transfers are free throughout the SEPA area via your eBanking (eboo or MultiLine).

The rate remains unchanged for transfers made at the point of sale.

You can check this in several ways:

- Via the eboo application: the transfer will appear in the transaction history as "executed" or "credited".

- Ask the beneficiary. He should receive the funds in seconds and can confirm receipt very quickly.

There can be several reasons, among others:

- VOP Unavailable: the payee verification service is not available for a short period.

- New beneficiary in eBanking: a blocking of instant payments is done for 5 days to avoid fraud. Classic transfers remain available.

- New device or browser: a blocking of instant transfers is carried out for 5 days when connecting to a new device or browser, in order to avoid fraud. Classic transfers remain available.

Frequently Asked Questions about VoP

Security - VoP strengthens fraud prevention (identity theft, fake payees…).

Fewer Errors - VoP reduces the risk of entering an incorrect name or IBAN.

Visibility - You are immediately informed if the entered data is consistent or needs verification.

For every newly added payee, as well as for all your transfers (standard and instant), the payee's identity is systematically verified. Three results may appear on your screen: Payee Validated, Payee Name Similarity, Payee Not Validated.

No. VoP simply informs you in case of inconsistency, but you always retain the choice to execute or cancel the payment.

VoP checks the name listed on the payee’s bank details.

Tip: Update the beneficiary in your eBanking to enter the full name as indicated on the beneficiary’s RIB or contact the beneficiary to confirm their bank details.

Refer to the bank account details (RIB) or the legal name of a company shown near the IBAN on an invoice. If in doubt, contact the payee.

Enter the payee using the full name of a person or the legal name of a company as indicated on the payee’s RIB, to avoid alerts or confusion.

VoP introduced by European regulation (EU) 2024/886, firstly concerns euro payments in the SEPA area (therefore SEPA transfers, SEPA instant payments, SEPA direct debits).

SEPA = 27 EU members + non-EU EEA countries (Iceland, Liechtenstein, Norway) + Switzerland + Monaco + San Marino + Andorra + Vatican + United Kingdom

When VoP indicates a mismatch between the name and the bank details, it is not necessarily fraud. VoP only checks the match between the name provided by the sender and the actual name registered by the payee’s bank.

In case of “Invalid payee”, we recommend verifying the information with the payee.

If you are unsure and cannot verify with the payee, we always recommend avoiding transfers to a payee not identified by VoP.

Do you have questions about opening an account?

Call us on 8002 8004 or +352 2424 8004 for international calls, Monday to Saturday from 7.00 am to 8.00 pm.