Enjoy the benefits of the POST VISA Gold card

Visa Gold

With your Visa Gold credit card, pay easily wherever you are, and get extensive insurance cover at a competitive price.

Our cards are environmentally friendly

All POST bank cards are made from recycled plastic or plant-based plastic made from cornstarch.

Our Visa Gold offer

Benefit from the Visa Gold card with the package eboo L.

ebooL

The package for worry-free travel

Included in this package

-

Current account

-

eBanking + Payconiq

-

Apple Pay + Google Pay

-

Raiffeisen advantages

-

Visa Debit card

-

Visa Gold credit card

-

Authorised overdraft

-

Access to eboo benefits

-

Visa Debit

-

Easy Visa

-

Visa

-

Visa Gold

Our extensive insurance coverage

Pay with Visa Gold and enjoy comprehensive insurance protection! You may be covered not only for day-to-day risks but also for problems when you’re travelling. All insurance and assistance is subject to special terms and conditions.

Trip cancellation

Need to cancel your trip due to illness, accident or a death in the family? Relax – we’re here to provide support and make sure you get your money back.

Lost and stolen baggage/baggage delay

Baggage gone astray? Don’t panic – the purchase of emergency essential items may be covered.

Winter sports

Skiing accident? Request a refund for any unused portion of your ski pass or skiing lessons. We may also cover the cost of hiring any replacement skis or snowboard.

Travel accident insurance

If you have an accident during your trip (plane, train, boat or bus), we can provide support and compensation.

Rental vehicle excess

Had a bump with your hire car while on holiday? We may refund the excess specified in your rental agreement.

Missed Departure

Did you miss a departure or a transport connection? Your tickets and the added costs may be refunded.

Missed Event

Did you miss a concert, a play, a sporting event (illness, quarantine, transportation strike, etc.)? Your tickets can be refunded.

Rental vehicle excess

Had a bump with your hire car while on holiday? We may refund the excess specified in your rental agreement.

Wrong fuel

Put the wrong fuel in your car? It happens! The cost of siphoning and cleaning may be covered.

Card Phishing

You communicated your card data to a malicious third party, who fraudulently took money from you? You can get compensation with the Phishing guarantee on your card.

Theft of keys / paperwork / wallet

Victim of robbery by assault or break-in? You can be refunded of the cost of replacing keys and identity papers, and of replacing or repairing your wallet.

Online shopping and delivery

You may be covered if the item you bought online turns out to be faulty, broken, incomplete or doesn’t match the description.

Purchase protection

You may be entitled to compensation in the event of accidental damage or theft of your item in the first 90 days following your purchase.

Extension of manufacturer’s guarantee

Benefit from a 24-month extension of the guarantee on your electrical, Hi-Fi, IT or multimedia equipment.

Personal assistance

We may organise transport or repatriation and provide support if you fall ill or have an accident during your trip. Search and rescue costs are also covered.

Assistance if insured vehicles and passengers stranded

Broken down and miles from home? You may be entitled to assistance (repairs, towing, repatriation, accommodation and transport, etc.)

Psychological assistance

If you’re the victim of a serious psychological shock (phishing, cyber harassment, identity theft), you may be able to access the services of a specialist psychologist.

Your advantages with Visa Gold

Free card payments worldwide

Make card payments worldwide in any currency, free of charge.

Free ATM withdrawals worldwide

Withdraw cash from any ATM worldwide (6) in any currency, free of charge. Limited to €2,500 per week. (1)

Free online transfers

Make online transfers free of charge to anywhere you want with your eBanking.

Secure online purchases

Make online purchases securely.

Assurances

Get premium purchase protection, death and disability cover, travel and general insurance.

Contactless

Make contactless payments up to €50.

Authorised overdraft

Enjoy repayments payable over 10 months for greater flexibility.

eboo benefits

Access a wide range of exclusive offers via eBanking and in-store, just using your Visa card.

Discover the eboo benefits related to your POST payment card

- Price cuts, reduced rates and good deals in Luxembourg and the greater region

- A wide range of partner merchants, from small to large brands

- Discounts on the online ticketing platform

- Discounts in shops on simple presentation of your POST payment card

- An evolving selection of partners, with flash promos and standing offers!

- For all tastes: shopping, amusement park, travels, and more…

Available exclusively to all holders of one or more POST bank cards and an eBanking access.

Order or change your pack

Appointment in an Espace POST

Open your account directly at one of our sale points, from Monday to Saturday.

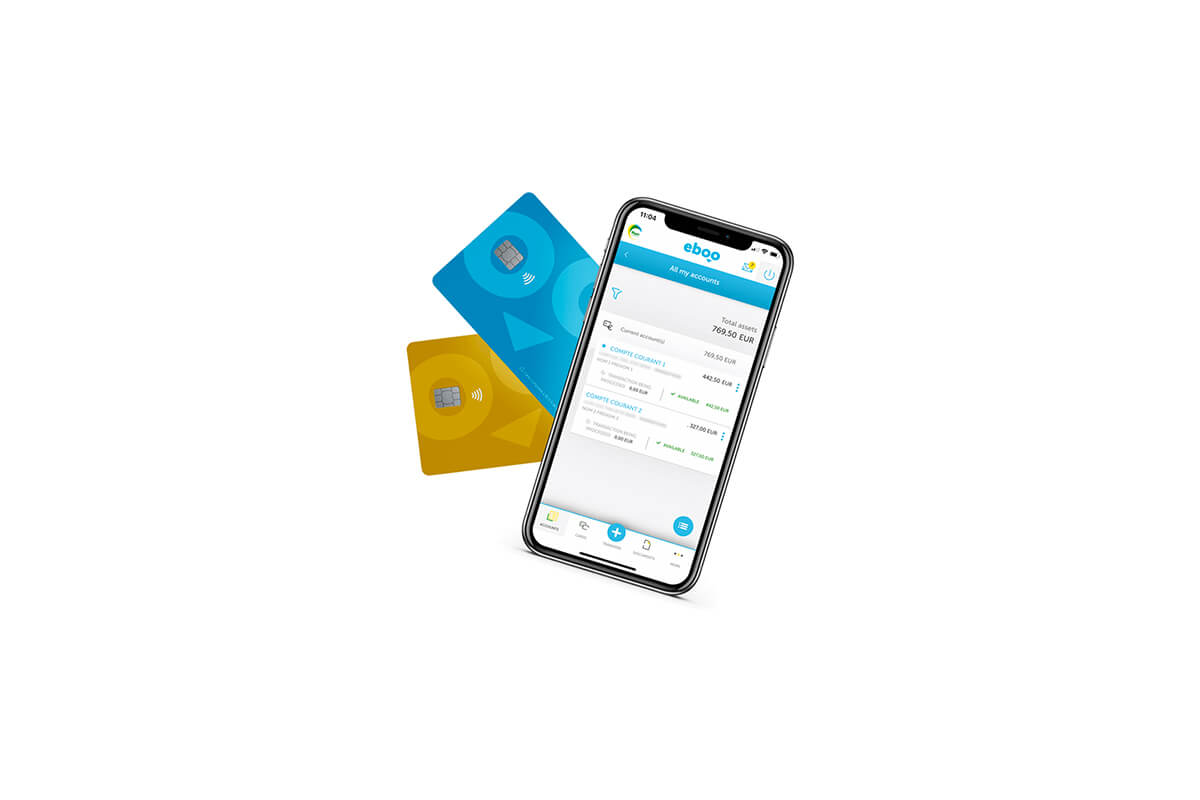

Change your pack in eboo

Already a POST Finance customer? You can change packs directly in your eboo eBanking app!

Change your Visa Gold card limit

If necessary, you can ask POST Finance to increase your credit card limit directly in your eBanking.

If your Visa Gold card is lost or stolen

Call +352 49 10 10 (available 24 hours a day) immediately to block your card. You will not be liable for transactions made after blocking your card.

Track your spending with your eboo account

With eboo, POST’s eBanking service, manage your money in a matter of clicks, remotely and in real time

eboo is available for PC, smartphone and tablet.

Related articles

eBanking with eboo

POST's eBanking to manage your accounts in a few clicks, remotely and in real time on your preferred device.

Discover our eBanking eboo

Borrowing and saving with Raiffeisen

As a POST Finance customer, seize the benefits of Raiffeisen!

Discover your advantages

Mobile payments with POST Payconiq

Convert your smartphone into a mobile payment device! Pay your purchases and your bills securely with Payconiq.

Discover Payconiq

Easy Visa

The Easy Visa prepaid bank card puts you in control of your budget. Top it up instantly whenever you need!

Discover Easy VisaDo you have any questions?

Call us on 8002 8004 or +352 2424 8004 for international calls, Monday to Saturday from 7.00 am to 8.00 pm.

1/ For a credit card, this limit is subject to the monthly limit offered by your card. For a debit card, this weekly limit cannot be changed.

2/ The V PAY card is accepted in these countries:

Countries of the European Union: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Countries outside the European Union: Andorra, Gibraltar, Greenland, Iceland, Israel, Liechtenstein, Norway, Switzerland, Turkey, United Kingdom.

3/ Annual interest rate of 12% on the outstanding balance. For expenses of 2,000€, a monthly repayment of 10% of the amount applies, i.e. 200€. To this is added 12% Visa interest calculated on the outstanding balance of 1,800€.

4/ Insurance for in-store purchases, online purchases and travel accidents. Applicable when paying with your Visa or Visa Gold card.

5/ Travel cancellation insurance, baggage protection, car rental, transport delay, winter sports, theft, phishing, multiples assistance and extended product warranty. Applicable when paying with your Visa Gold card.

6/ Unless explicitly stated otherwise on the ATM. Some banks or ATM operators may charge you a fee. POST Finance has no influence on their pricing policy.