Customs duties & formalities

Customs duties & formalities

Everything you need to know to send and receive goods outside the European Union.

Receiving shipments

General rules for shipments from outside the European Union.

All shipments from outside the European Union (imports) are subject to customs formalities. This includes import duties, VAT and excise duties, which may be charged to the recipient.

Duties and taxes are calculated based on the value of the goods shipped (price) plus transport costs.

Individual customers

- Pursuant to the new European Commission Directive (EU) 2017/2455, since 1 July 2021 all goods imported into the European Union will be cleared through customs and liable for Luxembourg VAT at a rate of 17%

- For gifts worth less than €45 (individual to individual): These shipments will not be taxed

VAT may be paid by the recipient:

- Directly to the online retailer, when the order is placed. The item will not be taxed upon delivery

- Upon delivery at home, via Payconiq or in cash. In the case of notified shipments, at the post office by credit card or cash

- By filing his own customs declaration or by using the services of a customs clearance professional, qualified as a customs representative (see Articles 18 and 19 of the Union Customs Code). In this case, the recipient must contact POST customer service (Tel 8002 8004 or +352 2424 8004 – contact.courrier@post.lu) before the shipment arrives in Europe.

- For consignments strictly valued at over €22, administrative fees of €18 are applied

- For consignments valued at under or equal to €22, administrative fees of €6 are applied

- Administrative fees include handling fees, customs presentation and declaration fees as well as storage fees at the sorting centre, and at the post office in the case of notified shipments

- Consignments with a value over €150 are cleared by CFL Logistics against an invoice and administrative fees

For future orders on online marketplaces, be sure to check the seller’s origin and the place of shipment.

POST Luxembourg shall not be held liable for any surcharges applied to your items in the event of non-compliance.

Business customers

All shipments to business customers (subject to VAT) are cleared by CFL multimodal, regardless of market value.

NB: Remember to supply your VAT number when you order, so that your shipment is processed accurately.

Shipping

Shipments to countries outside the European Union (export) are subject to a number of customs formalities.

- The sender must check which customs forms need to be completed for their international shipment

The sender is responsible for their declaration; they must complete and sign the relevant forms and attach them to their parcel

Shipments to European Union countries

For shipments to any of the 27 European Union countries, there is no need to complete and attach customs forms.

Shipments to countries outside the European Union

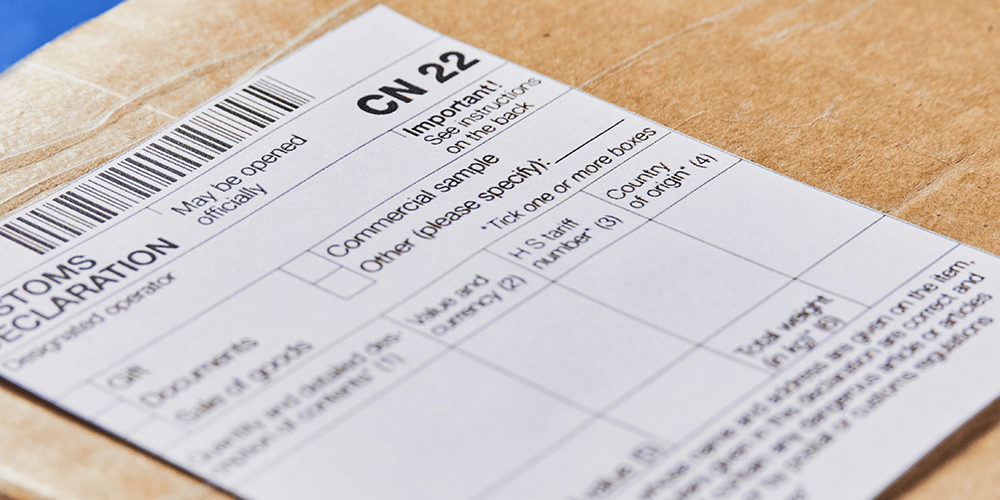

For shipments to countries outside the European Union, and depending on the total consignment value, a CN22 or CN23 customs declaration must be completed.

POST or the sender (via the MyPost area) is responsible for keeping detailed records of all customs information:

- Sender and recipient contact details

- Content of shipment

- Description of contents: description of each item, quantity, unit weight and unit value

Sales of goods

For sales of goods, the HS code and country of origin must also be indicated.

For consignments valued at over €1,000, you must enclose:

- An invoice (in duplicate) listing the contents’ value, which must be attached to the shipment in a see-through pouch. Where applicable, a pro forma invoice will suffice

- An import licence or certificate of origin for the items, depending on the destination

To find out what items are accepted in the country of destination, please check with the Customs and Excise Administration (ADA).

Download our brochure

Keep track of all the information regarding customs duties by downloading our brochure.

Find our postal files

Download the documents you may need. Prices, shipping procedures, order forms, restrictions, and more.