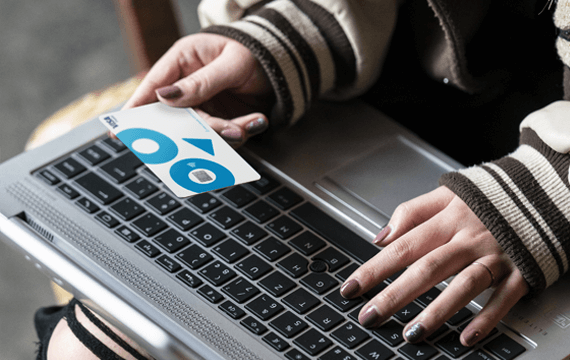

Apply for the V PAY card with POST Luxembourg

V PAY

With the V PAY debit card it’s easy to make payments and withdraw money for free in Luxembourg and in Europe. (2)

Our cards are environmentally friendly

All POST bank cards are made from recycled plastic or plant-based plastic made from cornstarch.

Your advantages with V PAY

Free card payments worldwide

Pay free of charge in Luxembourg and Europe at all businesses displaying the V PAY logo Limited to €2,500 per week. (1)

Free ATM withdrawals worldwide

Withdraw cash from any ATM in Luxembourg and in Europe in any currency, free of charge. Limited to €2,500 per week. (1)

Free online transfers

Make online transfers free of charge in EUR, CHF, GPB and USD to anywhere you want with your eBanking.

Contactless

Make contactless payments up to €50.

Track your spending with your eboo account

With eboo, POST’s eBanking service, manage your money in a matter of clicks, remotely and in real time

eboo is available for PC, smartphone and tablet.

If your card is lost or stolen or your PIN is disclosed,

call +352 49 10 10 (24/7) immediately to block your card. You will not be liable for transactions made after the card has been blocked.

Already a POST Finance customer?

If you are already a POST Finance customer, and wish to apply for a new account and/or card(s), Go to your eboo mobile app or www.eboo.lu.

1/ For a credit card, this limit is subject to the monthly limit offered by your card. For a debit card, this weekly limit cannot be changed.

2/ The V PAY card is accepted in these countries:

Countries of the European Union: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Countries outside the European Union: Andorra, Gibraltar, Greenland, Iceland, Israel, Liechtenstein, Norway, Switzerland, Turkey, United Kingdom.

3/ Annual interest rate of 12% on the outstanding balance. For expenses of 2,000€, a monthly repayment of 10% of the amount applies, i.e. 200€. To this is added 12% Visa interest calculated on the outstanding balance of 1,800€.

4/ Insurance for in-store purchases, online purchases and travel accidents. Applicable when paying with your Visa or Visa Gold card.

5/ Travel cancellation insurance, baggage protection, car rental, transport delay, winter sports, theft, phishing, multiples assistance and extended product warranty. Applicable when paying with your Visa Gold card.

6/ Unless explicitly stated otherwise on the ATM. Some banks or ATM operators may charge you a fee. POST Finance has no influence on their pricing policy.

Related articles

eBanking with eboo

POST's eBanking to manage your accounts in a few clicks, remotely and in real time on your preferred device.

Discover our eBanking eboo

Borrowing and saving with Raiffeisen

As a POST Finance customer, seize the benefits of Raiffeisen!

Discover your advantages

Mobile payments with POST Payconiq

Convert your smartphone into a mobile payment device! Pay your purchases and your bills securely with Payconiq.

Discover Payconiq

Easy Visa

The Easy Visa prepaid bank card puts you in control of your budget. Top it up instantly whenever you need!

Discover Easy VisaDo you have any questions?

Call us on 8002 8004 or +352 2424 8004 for international calls, Monday to Saturday from 7.00 am to 8.00 pm.